Disclosure: Affiliate links may be used in this post and at no extra cost to you, I may earn a small commission. Know that I only recommend products/services I personally use and stand behind.

Living on a tight budget can really be a stressful state to be in😰. Budgeting, as it may sound, is never easy. And making a way out of the debt pool is even more demanding.

So, if you’re looking for the top tips to live on a tight budget comfortably, you’ve arrived!

A recent study showed that 80% of Americans are entangled in the chains of debt.

D.E.B.T. for sure is a Dream-Crusher!

While I don’t intend to scare you off, but, if somehow you happen to be in the darker boots, it’s high time to acknowledge it. And start making more responsible decisions.

That being said, living on a tight budget doesn’t necessarily need to be a daunting endeavor. Dealt with a positive mindset, it can be a fun and enjoyable experience.

Already, it seems minimalism is the new trend. So, you just need to swing with the flow.

Note: Along with some phenomenal strategies and tips to live on a tight budget comfortably, I’ve also recommended some apps and sites. They work for me like crazy. I’m sure if you use the same, you’ll make and save much much more money. All the best!🙌

And, here are the top 11 easy ways to make ends meet on a strict budget…

1. Budget & Plan

“What gets measured, gets managed!”

Budgeting is insanely important when you’re on a tight budget. Undoubtedly, it’s the #1 of the tips to live on a tight budget.

It’s only when you track every penny, that you realize what can you afford and what needs to be slashed out.

Budgeting done the right way will not only maintain sustainable savings for you but also, save you from any future debt or financial stress.

And, it doesn’t have to be professional, and you need not be a finance expert to pull it off.

Just take a pen and paper, and follow the 3 simple steps below:

- List all of your expenses

- Remove everything you don’t necessarily need

- Look out for cheaper alternatives for the remaining items

Having done that you’ll automatically realize that you’re not in such an awful position you always thought yourself to be in.

Everything else can be saved for the savings or emergency fund.

Guys😎, Heads up! If you couldn’t find a sheet of paper nearby or your favorite pen got missing, I have got an awesome budgeting app for you. It’s called MINT. And, it’s absolutely free😮!

2. Cut Down Unnecessary Expenses

Maybe, you are too busy to do the budgeting stuff. Or you hopped the last paragraph🏃♂️.

Anyways, budget or not, you can’t afford to spend money recklessly if you’re on a low budget.

You have to cut down all of your unnecessary expenses.

I know it’s hard. It’s. Terribly. Hard.

Honestly, what else can you do when you’re on a tight budget. There will be more ‘NO’ than ‘YES’. And you will need to save money!

You can’t hop into Starbucks every now and then. Neither can you dispose of your Crocs until it’s absolutely the time.

That’s conscious and responsible saving. And that will have a monumental impact on your financial state in the long run.

Don’t forget to check out this post: 15 Easy Ways You Can Reduce Your Expenses

3. Side-Hustle Gigs

One of the best ways to achieve financial bliss is to somehow increase your income. (No! No! You don’t need to rob your neighbors 😑)

Instead, you can start with side-hustle gigs and easily earn money online.

While it may not be a significant boost to your income at the start, but anyways, every penny counts when you’re trying to live on a tight budget comfortably.

Also, once, you’ve mastered the skill (whatever you choose), you can set your own prices, and even, turn your side-hustle into a full-time business.

Looking for the best side-hustles or freelancing sites, here is your treasure trove:

4. Substitute Cards with Cash

If you want to hear the single best old-school saving advice, that works flawlessly even today, get ready, now is the time.🤨

Purchase in cash. Not with a credit or a debit card!

However simple it may seem, it works splendidly.

Living on a strict budget, your resources are very limited.

Let’s understand the psychology when purchases are made in cash.

Suppose you earn 50 currency notes of some denomination every month. And you know it. It’s so simple to count and remember.

Then, if you end up intending to buy your favorite gaming console, only to pay in cash this time; you could feel the pain of getting separated from your hard-earned money.

Every other note you count will force you to ponder upon the expense. “Is it worth paying so much?”

You might not be able to calculate the amount you have, but counting currency notes, that’s a cakewalk.

While you still won’t necessarily drop the product from your list, but, it certainly gives a very clear perspective to what you can afford. And sometimes, if it’s not really worth it, you would just get rid of it.

Now, this doesn’t happen when you pay with cards. It’s just a tap/swipe and go.

One-touch pay options have made us more wasteful than ever. While it definitely has many advantages, but on a budget, it’s not something to idolize.

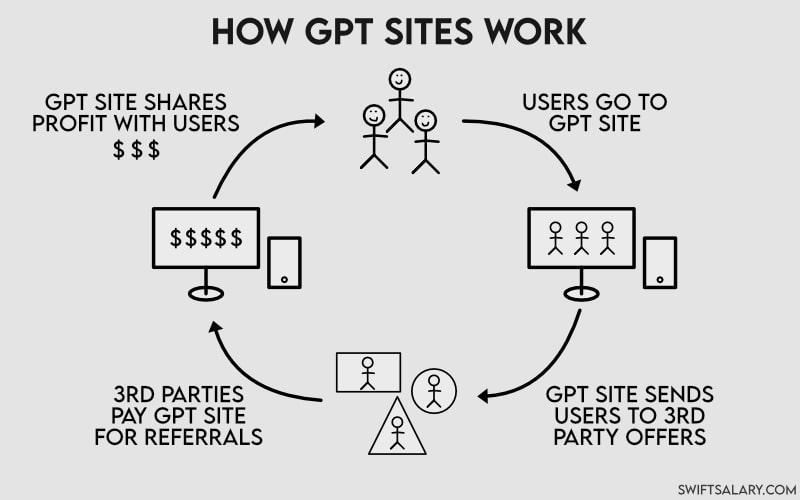

5. Get-Paid-To Sites & Apps

If you frequently visit Passive Plunders, you probably know all about this already.

Like millions of other people, GPT Sites/Apps were the first online income technique that happened to me.

Back then, I used my mom’s mobile, and I could easily earn enough to get it recharged on time. Every time.

It was when I was just 9-10🤓. And things have changed now. Only for the better.

There are more GPT Sites & Apps, more types of tasks, more rewards, and more of everything.

Guess what? You don’t even need to invest much time. Neither is there any fixed time slot to complete the tasks.

You can earn with GPT Sites anywhere and anytime. Whether on the commute to your workplace or in the swimming pool taking underwater lessons🥶.

Having read that, you might want to instantly get to such sites. If so, here are my personal favorites:

If you want to know more about ySense and how to successfully set up your account and earn money, we’ve got a complete review on ySense published already. Do give it a read.

6. Get Paid for Your Opinion

You might find it hard to believe, but, brands are freaking crazy to get your feedback. To a level, that they’ll pay you decent money. No strings attached!

Just give your honest opinion on their products and services and see your cash flow in.

It hardly takes 15-20 minutes to complete a survey. And the payout, most often, is worth the time. So, that’s fast cash.

Below, I’ve recommended some survey sites that are the best on the Internet. Give them a try:

7. Money Saving Apps

How about saving money every time you shop online? Interesting, right?

Yeah, you can earn cashback on every purchase you make online. Get discounts and rewards, too.

(Well! living on a low budget and saving money go hand in hand. You can’t afford to go any other way)

These sites/apps are free to use. Just signup and begin saving money.

Huh! Don’t get confused. You’ll still be purchasing directly from your favorite store. And not from them. They’ll just redirect you to the store and track your purchase to get you cashback and exclusive discounts.

If you’re an Indian citizen, then, probably, you’ll face problems in purchasing in dollars, right? For such cases, I recommend CashKaro.

CashKaro works the same as Rakuten or Dosh, but, it is focused on the Indian market. You’ll find almost all of the Indian e-commerce sites like Flipkart, Myntra, etc. And all the International brands too.🤑

8. Money from Money

Up till now, you’ve already got to know how to do budgeting the right way, make money online and even save on your daily expenses. What about the money you’re still left with?

INVEST.

Now, don’t get mad at me😠. You could always invest safely in a bank account. There’s no risk and money grows passively.

That being said, if you want to up your game, you’ll need to move on to stocks or such equities. The millennial nerds can go for crypto.

(Note that crypto has really got tons of adrenaline🤸♀️. The highs and lows can get you crazy. Proper investment knowledge is advised.)

There’s more profit, but more risk. And while the risk is guaranteed, the profit isn’t.🥺

But, I don’t think investing at most 10% of your savings can do much harm. Though the choice is all yours and it all depends on the decisions you make.

Still, know that investing has got much easier now. All thanks to data and analytics.

Acorns is one such wonderful investment app. Created for newbie investors in mind, it will provide you with amazing tips on the go. You could also choose from smart portfolios designed by experts, that adjust automatically as you and your money grow. And, yes, it’s absolutely secure.

9. Turn On the Motivation

I sincerely wish and hope that you sail through your financial recovery without any hurdle. Yet, this may not be the case with everyone.

Honestly, sometimes the time will get really tough. Budgeting, they say, is not easy.

But, it doesn’t mean that you can’t do it. I know you’ll definitely pull it off.

Just in case, someday you feel really low and stressed, I’ve got a way out.

Learn from others. Don’t reinvent the wheel every time.

There are tons of debt-payoff stories already available on the net. Read them. They’re so powerful and exceptionally inspirational.

If they could do it, you surely could too..👍

(Even we intend to publish some debt-payoff stories on Passive Plunders. If you think you’ve got one, feel free to contact us! Oooops, that was behind-the-curtains talks🤗.)

Final Summary

Let not your tight budget restrain you from enjoying life.

You can make more money and save more money and soon the financial pressure will vanish.

Be positive and disciplined. And you will have arrived.

So, these were the top 9 tips to live on a tight budget comfortably.

Hope you loved the article, if so, do share and spread the love.

Until then,

Stay Rich!

![10 Easy Steps to Earn Rs. 1000 Daily in India Without Investment [2022]](/wp-content/uploads/2022/04/onecode-app-earn-money-daily.webp)